If you’re anything like us, you love a good piece of biltong. Not only is…

3 Myths About Invoice Factoring You Need to Stop Believing

When you’re a small business, it’s tough to keep up with the bills while you’re waiting for clients to pay their invoices. This is where invoice factoring Australia wide can come in and help. Factoring allows businesses to borrow money against the value of their unpaid invoices. Businesses can get funding in as little as 24 hours, and there are no credit checks or application fees. However, there are a lot of myths out there about invoice factoring. So we’re going to dispel three of the most common myths about invoice factoring.

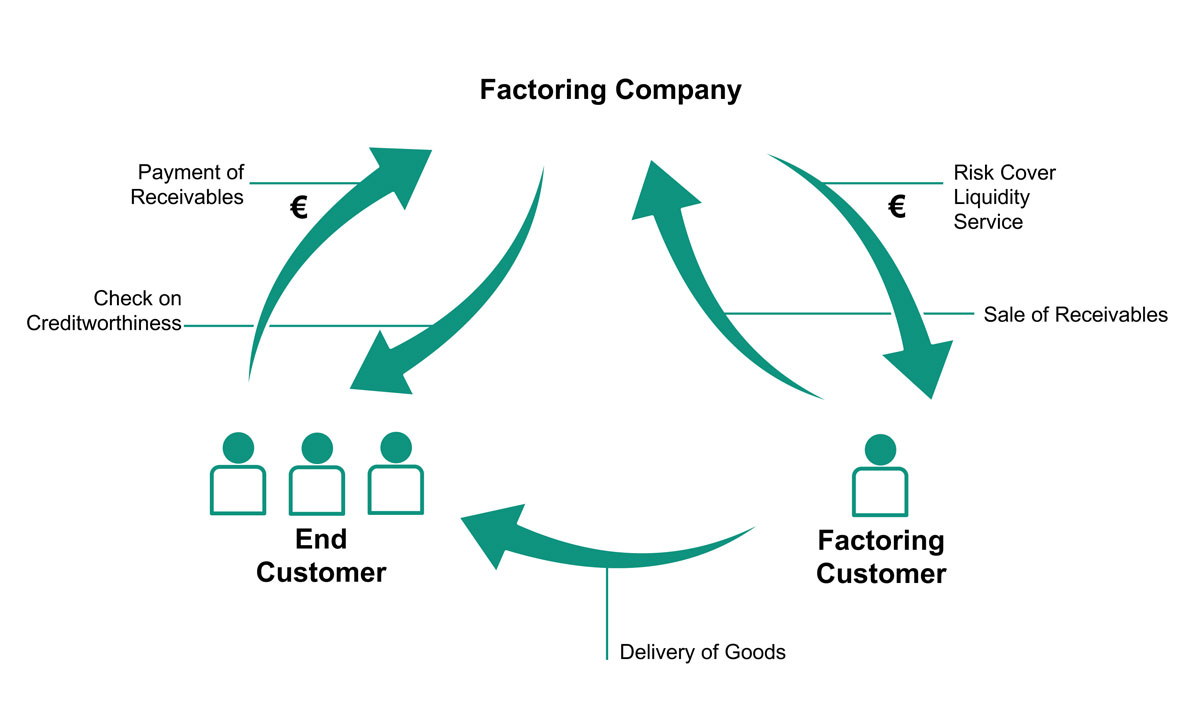

What is invoice factoring?

Invoice factoring is the process of selling unpaid invoices to a third party, called a factor, in exchange for an immediate cash payment. The factor then becomes the customer of the business and is responsible for collecting the invoice. It’s a quick and easy way to get cash flow relief without having to wait for customers to pay their bills.

There are a lot of myths out there about invoice factoring, and it’s important to dispel them before you decide if it’s the right solution for your business. Here are three of the most common myths about invoice factoring:

MYTH #1: Factoring is a short-term solution

Many business owners believe that invoice factoring is a short-term solution, but this couldn’t be further from the truth. Factoring is a long-term financing solution that can help businesses stabilise cash flow and grow their business. Factoring is especially beneficial for businesses that have slow-paying customers or that experience seasonal fluctuations in sales.

MYTH #2: Factoring is expensive

Many business owners believe that invoice factoring is expensive, but this isn’t always the case. Invoice factoring can be a more affordable option than traditional loans in some cases. The cost of invoice factoring will vary depending on the factors involved, such as the credit quality of your customers and the number of funds you need. However, invoice factoring often comes with lower interest rates and fees than other financing options. So if you’re looking for a more affordable way to get cash flow relief, invoice factoring may be a good option for you.

MYTH #3: Factoring is only for businesses with bad credit

Just because a business needs invoice factoring doesn’t mean its credit is bad. Invoice factoring can actually help businesses improve their credit score. How? By improving their cash flow and making it easier to pay off bills on time. This, in turn, shows lenders that the business is responsible and can be trusted with larger loans in the future.

How does invoice factoring work?

Invoice factoring is a process where a business sells its accounts receivable (invoices) to a third party, called invoice factoring companies. The factoring company then pays the business in cash, minus a fee, for the invoices.

This can provide the business with the needed cash flow to cover its expenses until the invoices are paid. How does it work? The business sells its accounts receivable at a discount to the factoring company in order to get cash upfront. This can provide your business with the cash it needs to keep operating while waiting for customers to pay their invoices.

What are the benefits of invoice factoring?

Factoring can provide your business with a number of benefits, including:

– improved cash flow, as you can get paid for your invoices almost immediately

– saving time and administrative hassle, as the factor will take care of collecting payments from your customers

– improved credit score and borrowing power, as having an invoice factoring arrangement in place signals to lenders that your company is healthy and has a good credit history

Conclusion:

Factoring is a great option for businesses of all sizes, and it can provide a host of benefits that other financing options can’t. By debunking these three myths about invoice factoring in Australia, we hope to give you a better understanding of what this financing option can offer your business.